Navigating healthcare coverage can be complex, especially when it comes to specific procedures like vasectomies. For individuals considering this form of contraception, understanding whether their insurance provider covers vasectomies is crucial.

Blue Cross Blue Shield (BCBS) is one of the largest healthcare insurance providers in the United States, offering a range of coverage options to its members. In this article, we’ll explore whether Blue Cross Blue Shield covers vasectomies, providing insights into the factors that may influence coverage eligibility, potential costs, and considerations for individuals seeking this contraceptive option.

Understanding Does Blue Cross Blue Shield Cover Vasectomy is the extent of insurance coverage for vasectomies under Blue Cross Blue Shield can help individuals make informed decisions about their reproductive health and family planning options.

Does Blue Cross Blue Shield Cover Vasectomy

Vasectomy is a common and effective form of permanent contraception for individuals seeking to prevent pregnancy. However, whether Blue Cross Blue Shield covers vasectomy procedures can vary depending on several factors, including the specific insurance plan, state regulations, and individual eligibility criteria. Here’s a detailed overview of considerations related to vasectomy coverage under Blue Cross Blue Shield:

Insurance Plan Coverage:

The extent of coverage for vasectomy procedures may vary depending on the specific insurance plan selected by the individual or employer. Blue Cross Blue Shield offers a range of insurance plans with varying levels of coverage for medical procedures, including contraception.

Some plans may cover vasectomies as a preventive service, while others may require the individual to meet certain deductible or copayment requirements.

State Regulations:

State regulations may influence insurance coverage for vasectomy procedures under Blue Cross Blue Shield. While some states mandate insurance coverage for vasectomies as part of comprehensive contraceptive coverage requirements, others may allow insurance companies to determine coverage based on individual plan provisions.

Individuals should consult their state’s insurance regulations and their specific insurance plan documents to understand coverage eligibility for vasectomy procedures.

Preventive Services:

Under the Affordable Care Act (ACA), insurance plans, including those offered by Blue Cross Blue Shield, are required to cover certain preventive services without cost-sharing for policyholders.

These preventive services include contraceptive methods and counseling for individuals of reproductive age. While vasectomy is considered a preventive contraceptive measure, coverage eligibility may vary depending on the specific plan and state regulations.

Coverage Eligibility Criteria:

Individuals considering vasectomy procedures should review their insurance plan documents and consult with their healthcare provider to determine coverage eligibility criteria.

Insurance coverage for vasectomies may be subject to certain eligibility requirements, such as medical necessity criteria, age restrictions, and prior authorization requirements. Meeting these criteria is essential for ensuring coverage for vasectomy procedures under Blue Cross Blue Shield.

Out-of-Pocket Costs:

Even if vasectomy procedures are covered under a Blue Cross Blue Shield insurance plan, individuals may still incur out-of-pocket costs, such as deductibles, copayments, or coinsurance.

Understanding the potential financial implications of vasectomy procedures can help individuals plan for any associated costs and make informed decisions about their contraceptive options.

Individuals should contact their insurance provider or review their plan documents to determine the extent of coverage and any potential out-of-pocket expenses for vasectomy procedures.

Summary Of Does Blue Cross Blue Shield Cover Vasectomy:

Whether Blue Cross Blue Shield covers vasectomy procedures depends on various factors, including the specific insurance plan, state regulations, and individual eligibility criteria. While some insurance plans may cover vasectomies as a preventive service without cost-sharing, others may require individuals to meet certain requirements or incur out-of-pocket costs. I hope this answers the question of Does Blue Cross Blue Shield Cover Vasectomy.

Understanding Vasectomy

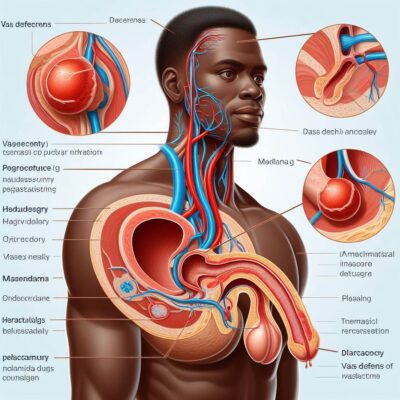

Vasectomy is a surgical procedure that serves as a permanent form of contraception for individuals seeking to prevent pregnancy. While the decision to undergo a vasectomy is deeply personal, understanding the procedure, its implications, and its effects is crucial.

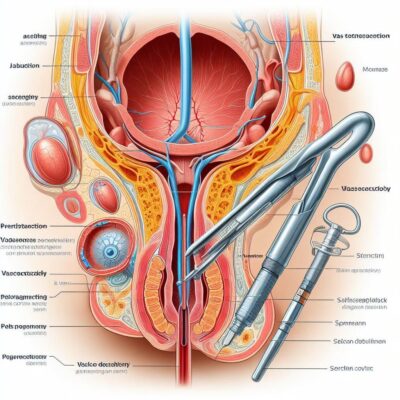

Vasectomy involves the surgical cutting or blocking of the vas deferens, the tubes that carry sperm from the testicles to the urethra. By interrupting the flow of sperm, vasectomy prevents fertilization and effectively eliminates the risk of pregnancy.

Let’s delve into the details of vasectomy, exploring its mechanism, effectiveness, considerations, and potential impacts on sexual health and fertility. Understanding vasectomy can empower individuals to make informed decisions about their reproductive choices and family planning options.

Understanding:

Vasectomy is a surgical procedure designed to provide permanent contraception for individuals seeking to prevent pregnancy. Here’s a comprehensive overview of vasectomy, including its mechanism, effectiveness, considerations, and potential impacts:

Mechanism:

During a vasectomy procedure, the vas deferens, the tubes that carry sperm from the testicles to the urethra, are surgically cut, blocked, or sealed.

This interruption prevents sperm from reaching the semen ejaculated from the penis during sexual intercourse. Without sperm in the semen, fertilization cannot occur, effectively eliminating the risk of pregnancy.

Effectiveness:

Vasectomy is highly effective as a form of contraception, with a success rate of over 99%. However, it’s important to note that vasectomy is not immediately effective in preventing pregnancy.

It takes several months and ejaculations to clear any remaining sperm from the reproductive system fully. During this time, alternative contraceptive methods should be used to prevent pregnancy.

Considerations:

Before undergoing a vasectomy, individuals should carefully consider several factors, including their reproductive goals, desire for children in the future, and potential risks and benefits of the procedure.

Vasectomy is intended to be permanent, and reversal procedures are complex and not always successful. Therefore, individuals should be certain of their decision and understand the implications of vasectomy on their fertility and sexual health.

Procedure:

Vasectomy is typically performed as an outpatient procedure under local anesthesia. The surgeon makes small incisions in the scrotum to access the vas deferens, which are then cut, tied, or sealed using various techniques.

The procedure is minimally invasive and generally well-tolerated, with minimal discomfort and a short recovery time.

Potential Impacts:

While vasectomy does not affect sexual function, libido, or hormone levels, some individuals may experience psychological or emotional effects following the procedure.

It’s important for individuals to have open and honest discussions with their healthcare provider about their concerns and expectations regarding vasectomy.

Fertility After Vasectomy:

Although vasectomy is considered a permanent form of contraception, it is possible to restore fertility through vasectomy reversal or sperm retrieval procedures.

However, these procedures are not always successful, and the chances of achieving pregnancy may be lower compared to before vasectomy.

Cost and Insurance Coverage:

The cost of vasectomy can vary depending on factors such as location, healthcare provider, and insurance coverage. Many insurance plans, including Medicaid and private insurance providers, cover vasectomy as a preventive service.

Individuals should check with their insurance provider to determine coverage eligibility and any associated costs.

Summary Of Understanding Vasectomy:

Vasectomy is a safe and effective form of permanent contraception for individuals seeking to prevent pregnancy. By understanding the mechanism, effectiveness, considerations, and potential impacts of vasectomy, individuals can make informed decisions about their reproductive choices and family planning options.

Consulting with a healthcare provider is essential for addressing any questions or concerns and ensuring that vasectomy is the right choice for individual circumstances.

How Much Does A Vasectomy Cost With Insurance?

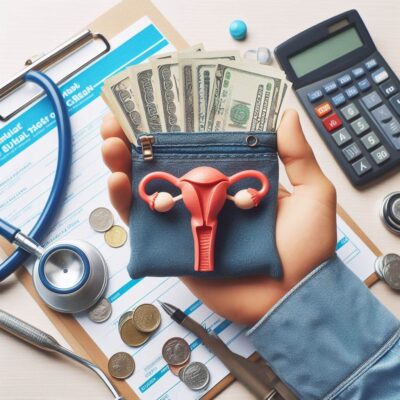

When considering a vasectomy as a form of contraception, one of the primary concerns for many individuals is the cost of the procedure. While the decision to undergo a vasectomy is deeply personal, understanding the potential financial implications, including the cost with insurance coverage, is essential.

Vasectomy is a safe and effective permanent contraceptive option for individuals seeking to prevent pregnancy. However, the cost of the procedure can vary depending on several factors, including insurance coverage, healthcare provider, and geographic location.

In this article, we’ll explore the typical cost of a vasectomy with insurance coverage, factors that may influence the cost, and considerations for individuals seeking this form of contraception.

Understanding the financial aspects of vasectomy with insurance can help individuals make informed decisions about their reproductive health and family planning options.

Guide On Vasectomy Cost With Insurance:

The cost of a vasectomy with insurance coverage can vary depending on several factors, including the specific insurance plan, deductible, copayment, coinsurance, and any out-of-pocket expenses. Here’s a detailed overview of the typical cost considerations for a vasectomy with insurance:

Insurance Coverage:

Many insurance plans, including private health insurance and Medicaid, cover vasectomy as a preventive service. Under the Affordable Care Act (ACA), insurance plans are required to cover certain preventive services, including contraception, without cost-sharing for policyholders.

However, coverage for vasectomy may vary depending on the specific insurance plan and individual policy provisions.

Deductible:

The deductible is the amount individuals are required to pay out of pocket for covered services before insurance coverage begins. The cost of a vasectomy with insurance coverage may be subject to the deductible, meaning individuals may need to meet their deductible before insurance covers any portion of the procedure.

Copayment or Coinsurance:

Even with insurance coverage, individuals may be responsible for copayments or coinsurance for vasectomy procedures. Copayments are fixed amounts paid for covered services, while coinsurance is a percentage of the total cost of the procedure.

The specific copayment or coinsurance amount for a vasectomy with insurance coverage depends on the individual’s insurance plan and policy provisions.

Out-of-Network Providers:

If individuals choose to undergo a vasectomy with an out-of-network healthcare provider, they may incur higher out-of-pocket costs compared to in-network providers.

Insurance plans typically have negotiated rates with in-network providers, which may result in lower costs for covered services. Individuals should verify whether their chosen healthcare provider is in-network to maximize insurance benefits and minimize out-of-pocket expenses.

Preauthorization Requirements:

Some insurance plans may require preauthorization or prior authorization for vasectomy procedures. Preauthorization is the process of obtaining approval from the insurance company before receiving certain medical services.

Individuals should check with their insurance provider to determine if preauthorization is required for a vasectomy and follow any necessary steps to ensure coverage.

Additional Costs:

In addition to the cost of the vasectomy procedure itself, individuals may incur additional costs for preoperative consultations, postoperative care, medications, and follow-up visits. These additional expenses should be considered when estimating the total cost of a vasectomy with insurance coverage.

Coverage Eligibility:

While many insurance plans cover vasectomy as a preventive service, coverage eligibility may vary depending on factors such as medical necessity, age restrictions, and state regulations.

Individuals should review their insurance plan documents, consult with their healthcare provider, and contact their insurance provider to determine coverage eligibility and any associated costs.

What Is Eligibility For Coverage?

Understanding eligibility for coverage is crucial for individuals navigating the complex landscape of healthcare insurance. Eligibility criteria determine whether an individual qualifies for coverage under a specific insurance plan and outline the scope of benefits available.

Whether seeking coverage for routine medical services, specialized treatments, or elective procedures, knowing the eligibility requirements can help individuals make informed decisions about their healthcare options.

By understanding eligibility for coverage, individuals can better navigate the healthcare system and access the necessary medical care to support their health and well-being.

Eligibility For Coverage:

Eligibility for coverage refers to the criteria that determine whether an individual qualifies for insurance coverage under a specific healthcare plan. Eligibility criteria vary depending on factors such as the type of insurance plan, the insurance provider, and state regulations.

Here’s a detailed look at the factors that influence eligibility for coverage:

Insurance Plan Type:

The type of insurance plan, such as employer-sponsored health insurance, individual health insurance, Medicaid, or Medicare, affects eligibility for coverage. Each type of insurance plan may have different eligibility requirements and benefits.

Employment Status:

Many individuals receive health insurance coverage through their employer as part of an employee benefits package. Eligibility for employer-sponsored health insurance typically depends on factors such as full-time or part-time employment status, length of employment, and company policies.

Income Level:

Eligibility for certain types of insurance coverage, such as Medicaid and subsidized health insurance plans through the Health Insurance Marketplace, may be based on income level.

Individuals with incomes below a certain threshold may qualify for financial assistance or Medicaid coverage, while higher-income individuals may be eligible for unsubsidized health insurance plans.

Residency Status:

Some insurance plans, particularly Medicaid and state-based health insurance programs, require individuals to be legal residents of the state in which they are applying for coverage.

Residency status may be verified through documentation such as proof of address, identification, and immigration status.

Age:

Certain insurance plans, such as Medicare and the Children’s Health Insurance Program (CHIP), have age-based eligibility criteria. Medicare provides health insurance coverage for individuals aged 65 and older, as well as younger individuals with disabilities or specific medical conditions.

CHIP provides coverage for children from low-income families who do not qualify for Medicaid.

Preexisting Conditions:

The Affordable Care Act (ACA) prohibits insurance companies from denying coverage or charging higher premiums based on preexisting medical conditions. However, eligibility for certain types of coverage, such as short-term health insurance plans, may be impacted by preexisting conditions.

Other Factors:

Additional factors that may influence eligibility for coverage include immigration status, military service, enrollment periods, and special circumstances such as pregnancy or disability.

Individuals should review the specific eligibility criteria outlined by their insurance plan or program and provide accurate information when applying for coverage.

Tips For Blue Cross Blue Shield

Navigating the complexities of health insurance coverage can be a daunting task, but with the right information and strategies, individuals can maximize their chances of obtaining coverage that meets their healthcare needs.

Blue Cross Blue Shield (BCBS) is one of the largest and most well-known health insurance providers in the United States, offering a range of plans to individuals and families across the country.

Whether you’re seeking coverage for routine medical care, specialized treatments, or elective procedures, understanding how to navigate the enrollment process and optimize your coverage options with BCBS is essential.

By following these tips, individuals can make informed decisions about their healthcare coverage and access the services they need to support their health and well-being.

Tips For Getting Coverage:

Securing health insurance coverage with Blue Cross Blue Shield involves several steps and considerations. Here are some tips to help you navigate the process and maximize your coverage options:

Research Plan Options:

Start by researching the various health insurance plans offered by Blue Cross Blue Shield. Consider factors such as premium costs, deductible amounts, copayments, coinsurance rates, and coverage for specific healthcare services. Compare plan features and benefits to determine which plan best fits your needs and budget.

Understand Enrollment Periods:

Blue Cross Blue Shield typically offers open enrollment periods during which individuals can enroll in or make changes to their health insurance coverage. Be aware of the open enrollment dates and deadlines to ensure timely enrollment.

Additionally, certain life events, such as marriage, birth of a child, or loss of other coverage, may qualify you for a special enrollment period outside of the open enrollment period.

Check Eligibility Requirements:

Before applying for coverage with Blue Cross Blue Shield, review the eligibility requirements for the plan you’re interested in. Eligibility criteria may vary depending on factors such as employment status, income level, residency, and other factors.

Ensure that you meet the eligibility criteria before applying for coverage to avoid any delays or complications.

Gather Necessary Documents:

When applying for coverage with Blue Cross Blue Shield, you may need to provide documentation to verify your identity, residency, income, and other eligibility criteria.

Gather any required documents, such as proof of identity, proof of residency, pay stubs, tax returns, or other relevant paperwork, to streamline the application process.

Explore Subsidized Options:

Depending on your income level, you may qualify for subsidized health insurance options through Blue Cross Blue Shield or the Health Insurance Marketplace.

Subsidized plans offer financial assistance to help offset premium costs and reduce out-of-pocket expenses. Explore your eligibility for subsidized coverage and take advantage of available financial assistance programs.

Consider Supplemental Coverage:

In addition to standard health insurance plans, Blue Cross Blue Shield offers supplemental coverage options, such as dental insurance, vision insurance, and prescription drug coverage.

Consider whether supplemental coverage is necessary to address your specific healthcare needs and budget constraints.

Utilize Online Tools and Resources:

Blue Cross Blue Shield provides online tools and resources to help individuals navigate the enrollment process, compare plan options, estimate costs, and find healthcare providers in their network.

Take advantage of these online tools to make informed decisions about your coverage and healthcare options.

By following these tips, individuals can navigate the process of obtaining coverage with Blue Cross Blue Shield more effectively and make informed decisions about their healthcare options.

Remember to review plan details carefully, understand eligibility requirements, and take advantage of available resources to maximize your coverage benefits with Blue Cross Blue Shield.

List Of Blue Cross Plans Nationwide That Cover Vasectomy

When considering a vasectomy as a form of permanent contraception, individuals often inquire about health insurance coverage for the procedure. Blue Cross Blue Shield (BCBS) is a major health insurance provider in the United States, offering a wide range of plans with varying coverage options.

While coverage for vasectomy procedures may vary depending on the specific plan and location, many Blue Cross Blue Shield plans do provide coverage for vasectomies as a preventive service.

Come let’s explore a list of Blue Cross plans nationwide that cover vasectomy procedures, providing individuals with insights into potential coverage options and considerations when seeking insurance coverage for this elective procedure.

Understanding which Blue Cross plans offer coverage for vasectomies can help individuals make informed decisions about their reproductive health and family planning options.

List of Blue Cross plans nationwide:

While coverage for vasectomy procedures may vary depending on factors such as the specific plan, state regulations, and individual policy provisions, many Blue Cross Blue Shield plans nationwide offer coverage for vasectomy as a preventive service. Here’s a list of Blue Cross plans that commonly cover vasectomy procedures:

1. Blue Cross Blue Shield Federal Employee Program (FEP):

The Blue Cross Blue Shield Federal Employee Program provides health insurance coverage to federal employees, retirees, and their families. Many FEP plans offer coverage for vasectomy procedures as a preventive service, subject to plan-specific terms and conditions.

2. Blue Cross Blue Shield Association Plans:

Blue Cross Blue Shield Association plans, which include plans offered by individual BCBS companies across the country, often provide coverage for vasectomy procedures. Individuals enrolled in BCBS Association plans should review their specific plan documents to determine coverage eligibility and any associated costs.

3. Blue Cross Blue Shield Plans Through Health Insurance Marketplaces:

Blue Cross Blue Shield offers health insurance plans through Health Insurance Marketplaces established under the Affordable Care Act (ACA). Many of these plans cover vasectomy procedures as a preventive service, with coverage eligibility determined by plan-specific terms and regulations.

4. Blue Cross Blue Shield State Plans:

Each Blue Cross Blue Shield company operates independently in its respective state or region, offering a variety of health insurance plans to individuals and families. Many state-specific BCBS plans provide coverage for vasectomy procedures, although coverage may vary depending on state regulations and plan provisions.

5. Blue Cross Blue Shield Preferred Provider Organization (PPO) Plans:

Blue Cross Blue Shield PPO plans typically offer coverage for vasectomy procedures, allowing individuals to choose healthcare providers both in and out of the plan’s network. Coverage for vasectomy may be subject to plan-specific terms, deductibles, copayments, and coinsurance rates.

6. Blue Cross Blue Shield Health Maintenance Organization (HMO) Plans:

Blue Cross Blue Shield HMO plans may also cover vasectomy procedures, but coverage options and network limitations may vary depending on the plan. Individuals enrolled in HMO plans should consult their plan documents and network provider directories to determine coverage for vasectomy procedures.

7. Blue Cross Blue Shield High-Deductible Health Plans (HDHPs):

Individuals enrolled in Blue Cross Blue Shield HDHPs, often paired with Health Savings Accounts (HSAs), may have coverage options for vasectomy procedures. Coverage eligibility and out-of-pocket costs may vary depending on plan-specific deductible amounts, coinsurance rates, and HSA contributions.

It’s important to note that coverage for vasectomy procedures under Blue Cross Blue Shield plans may be subject to certain eligibility criteria, copayments, coinsurance rates, deductibles, and other plan-specific terms and conditions.

Individuals considering vasectomy procedures should review their insurance plan documents, consult with their healthcare provider, and contact their insurance provider to determine coverage eligibility and any associated costs.

Will You Gain Weight After A Vasectomy?

As individuals consider undergoing a vasectomy procedure for contraception, concerns about potential side effects often arise. One common question is whether weight gain is a possible outcome of vasectomy.

While vasectomy is a relatively straightforward surgical procedure that involves cutting or blocking the vas deferens to prevent the release of sperm, its impact on weight is a subject of debate.

While exploring the question: “Will you gain weight after a vasectomy?” We’ll delve into the factors that may contribute to weight changes post-vasectomy, examine scientific research on the topic, and provide insights to help individuals make informed decisions about their reproductive health without unnecessary worry about weight-related concerns.

Guide:

Weight gain after a vasectomy is a topic that has been discussed among individuals considering the procedure. While some anecdotal reports suggest a potential link between vasectomy and weight gain, scientific evidence supporting this claim is limited. Here are several factors to consider when evaluating the potential impact of vasectomy on weight:

Hormonal Changes:

Some individuals speculate that vasectomy could lead to hormonal changes that may influence weight regulation. However, vasectomy does not involve alterations to hormone production or metabolism.

The procedure simply prevents the release of sperm during ejaculation and does not affect hormone levels or balance in the body.

Lifestyle Factors:

Weight gain or loss is often influenced by lifestyle factors such as diet, exercise, stress levels, and sleep patterns. Following a vasectomy, individuals may experience temporary changes in their routines or habits due to recovery from the procedure or concerns about sexual activity.

These lifestyle changes, rather than the vasectomy itself, could potentially contribute to weight fluctuations.

Psychological Factors:

The decision to undergo a vasectomy may be accompanied by emotional or psychological factors that could indirectly impact weight. Stress, anxiety, or feelings of apprehension related to the procedure or concerns about its consequences may affect appetite, eating habits, and overall well-being.

Addressing these psychological factors through open communication, support, and coping strategies can help alleviate potential stressors and promote emotional well-being.

Individual Variability:

Every individual’s body responds differently to medical procedures, and there is no one-size-fits-all answer to how vasectomy may affect weight. Some individuals may experience no changes in weight following a vasectomy, while others may notice slight fluctuations due to various factors.

It’s essential to consider individual variability and recognize that weight changes post-vasectomy may not be directly attributed to the procedure itself.

Scientific Evidence:

While anecdotal reports and personal experiences may suggest a possible association between vasectomy and weight gain, scientific research on this topic is limited and inconclusive.

Several studies have investigated the potential relationship between vasectomy and weight changes but have not found consistent evidence to support a causal link.

Conclusion:

The question of whether Blue Cross Blue Shield (BCBS) covers vasectomy procedures is one that many individuals considering permanent contraception may have. Fortunately, BCBS, being one of the largest health insurance providers in the United States, often includes coverage for vasectomy as part of its comprehensive health plans.

However, coverage specifics can vary based on factors such as the specific plan, state regulations, and individual policy provisions. It’s crucial for individuals to review their plan documents, consult with their healthcare provider, and contact BCBS directly to understand coverage eligibility, any associated costs, and any preauthorization requirements.

By gaining clarity on coverage options, individuals can make informed decisions about their reproductive health and family planning needs. I hope now you understand Does Blue Cross Blue Shield Cover Vasectomy

FAQs:

Q1: As a contraceptive option Blue Cross Blue Shield cover vasectomy?

A: Yes, many Blue Cross Blue Shield plans offer coverage for vasectomy procedures as a preventive service.

Q2: Will I need to meet certain eligibility criteria to have a vasectomy covered by Blue Cross Blue Shield?

A: Eligibility criteria for coverage may vary depending on factors such as the specific plan, state regulations, and individual policy provisions. It’s important to review plan documents and consult with BCBS representatives for detailed information on eligibility requirements.

Q3: Does coverage for vasectomy include all associated costs, such as consultation fees and post-operative care?

A: Coverage for vasectomy procedures typically includes the cost of the procedure itself, but additional expenses such as consultation fees, preoperative testing, and post-operative care may vary depending on the plan. Individuals should review their plan documents and contact BCBS for clarification on coverage details. “Does Blue Cross Blue Shield Cover Vasectomy“

Q4: Are there any preauthorization requirements or restrictions for vasectomy coverage with Blue Cross Blue Shield?

A: Some BCBS plans may require preauthorization or prior authorization for vasectomy procedures. Individuals should check their plan documents and contact BCBS representatives to determine if preauthorization is necessary and follow any required procedures. “Does Blue Cross Blue Shield Cover Vasectomy“

Q5: Will I need to use an in-network healthcare provider for vasectomy coverage with Blue Cross Blue Shield?

A: Coverage for vasectomy procedures may be subject to network restrictions, with lower out-of-pocket costs for services provided by in-network healthcare providers. Individuals should verify the network status of their chosen provider and confirm coverage details with BCBS to minimize out-of-pocket expenses. “Does Blue Cross Blue Shield Cover Vasectomy“