In today’s world, where health and wellness are paramount concerns, individuals are constantly seeking innovative treatments to address a variety of medical conditions.

One such treatment gaining attention is ketamine therapy. Known primarily as an anesthetic and recreational drug, ketamine has shown promise in treating mental health disorders such as depression, anxiety, and PTSD when administered in controlled settings.

Understanding “Does Blue Cross Blue Shield Cover Ketamine Treatment“? However, as with any medical treatment, the question of coverage arises, particularly concerning insurance providers like Blue Cross Blue Shield. In this article, we delve into the intricacies of Blue Cross Blue Shield’s coverage of ketamine treatment. Join us as we navigate the maze of policies and considerations to provide you with a comprehensive understanding of this important issue.

Does Blue Cross Blue Shield Cover Ketamine Treatment

Ketamine treatment has emerged as a potential breakthrough for individuals struggling with treatment-resistant depression and other mental health disorders. However, for many considering this option, the crucial question remains: Does Blue Cross Blue Shield cover ketamine treatment?

The answer to this question is not as straightforward as one might hope. Blue Cross Blue Shield, like many insurance providers, evaluates coverage for ketamine therapy on a case-by-case basis. While some plans may offer coverage for ketamine treatment under certain circumstances, others may not include it in their list of covered services.

The decision to cover ketamine therapy often depends on several factors, including the individual’s diagnosis, the treating physician’s recommendation, and the specific terms of the insurance plan. In some cases, Blue Cross Blue Shield may require prior authorization or documentation of medical necessity before approving coverage for ketamine treatment.

It’s essential for individuals considering ketamine therapy to thoroughly review their insurance policy’s coverage details and consult with their healthcare provider to determine the potential costs and coverage options available to them.

Additionally, reaching out to Blue Cross Blue Shield directly can provide clarity on their specific coverage policies regarding ketamine treatment. I hope now you understand what Blue Cross Blue Shield Cover Ketamine Treatment

What Is Blue Cross Blue Shield?

Navigating the complex landscape of healthcare can often feel like traversing uncharted territory, with a myriad of terms, policies, and providers to decipher. In the United States, one of the most recognized names in health insurance is Blue Cross Blue Shield.

From its humble beginnings to its current status as a nationwide network of independent companies, Blue Cross Blue Shield has played a significant role in shaping the healthcare landscape. In this article, we embark on a journey to unravel the mysteries of Blue Cross Blue Shield, exploring its origins, structure, and the services it provides.

Join us as we uncover the story behind this iconic healthcare brand and gain a deeper understanding of its role in ensuring access to quality care for millions of Americans.

Blue Cross Blue Shield (BCBS) is a federation of independent health insurance companies operating in the United States. The federation traces its roots back to the early 20th century when the first Blue Cross organization was established in 1929 by Justin Ford Kimball, a hospital administrator in Texas.

Initially created to provide prepaid hospital care to teachers, the concept of Blue Cross quickly gained popularity and expanded to other states.

In 1939, a similar organization called Blue Shield was founded to offer physician services. Over time, these separate entities merged and evolved into what is now known as Blue Cross Blue Shield, encompassing both hospital and physician coverage under one umbrella.

Today, Blue Cross Blue Shield comprises 36 independent and locally operated companies that collectively provide health insurance coverage to over 100 million Americans.

While each Blue Cross Blue Shield company operates independently and serves specific geographic regions, they are united by a common mission to improve access to affordable healthcare and promote health and wellness in their communities.

Blue Cross Blue Shield offers a wide range of health insurance products, including individual and family plans, employer-sponsored coverage, Medicare plans, and Medicaid-managed care. These plans vary in coverage options, benefits, and premiums, allowing individuals and families to choose the plan that best fits their healthcare needs and budget.

Overall, Blue Cross Blue Shield plays a vital role in the American healthcare system, providing millions of individuals and families with access to essential health services and helping to safeguard their financial well-being in times of illness or injury. “Does Blue Cross Blue Shield Cover Ketamine Treatment“

Does Lumin Health Accept BCBS?

Our health and well-being are paramount, and having access to quality healthcare is crucial in maintaining a healthy lifestyle. When it comes to choosing a healthcare provider, understanding which insurance plans they accept is vital for ensuring seamless access to care while minimizing out-of-pocket expenses.

Lumin Health, a comprehensive healthcare organization renowned for its patient-centered approach and advanced medical services, is a sought-after destination for individuals seeking top-notch care. However, for those covered by Blue Cross Blue Shield (BCBS) insurance plans, the burning question arises: Does Lumin Health accept BCBS?

In this article, we delve into this important query, providing clarity on the relationship between Lumin Health and Blue Cross Blue Shield to assist individuals in making informed decisions about their healthcare options.

Guide:

When it comes to determining whether Lumin Health accepts Blue Cross Blue Shield (BCBS) insurance plans, several factors come into play. Here’s a breakdown of the key points to consider:

1. Network Participation:

Lumin Health’s acceptance of BCBS insurance varies depending on its agreements and contracts with different Blue Cross Blue Shield companies.

Some Lumin Health facilities and providers may be in-network with certain BCBS plans, while others may not participate in the network.

2. Verification of Coverage:

Individuals covered by BCBS insurance should verify Lumin Health’s network participation directly with both Lumin Health and their BCBS insurance provider.

Contacting Lumin Health’s billing department or checking their website can provide information on accepted insurance plans.

3. Insurance Plan Details:

The specific BCBS insurance plan you have may determine whether Lumin Health is in-network.

Different BCBS plans may have varying levels of coverage and out-of-network benefits, impacting the cost of services received at Lumin Health.

4. Coverage Considerations:

Even if Lumin Health is in-network with BCBS, certain services, procedures, or specialists may not be covered under your specific insurance plan.

It’s essential to review your BCBS insurance policy to understand the scope of coverage and any limitations or exclusions that may apply.

5. Communication and Coordination:

Open communication between individuals, Lumin Health, and BCBS is crucial in navigating insurance coverage and understanding potential out-of-pocket expenses.

Clarifying coverage details and obtaining pre-authorization, if required, can help prevent surprises and ensure a smooth healthcare experience.

While Lumin Health may accept certain Blue Cross Blue Shield insurance plans, individuals should proactively verify their coverage and understand the terms of their insurance policy to make informed decisions about their healthcare.

By communicating with both Lumin Health and BCBS, individuals can navigate insurance complexities and access the care they need with confidence.

What Are The Potential Benefits Of Ketamine Treatment?

In recent years, the landscape of mental health treatment has undergone a significant transformation with the emergence of innovative therapies aimed at addressing conditions like depression, anxiety, and PTSD.

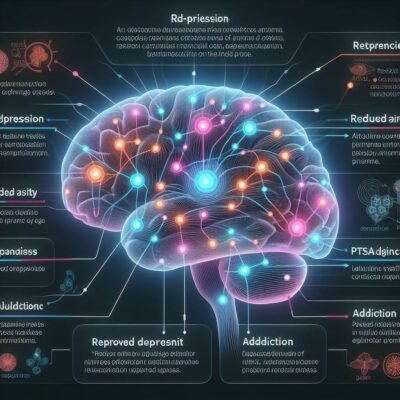

One such treatment that has garnered attention is ketamine therapy. Originally known for its anesthetic properties, ketamine has shown promise in the treatment of various mental health disorders, offering new hope to individuals who have not responded to traditional therapies.

The potential benefits of ketamine treatment, exploring how this unconventional approach is reshaping the field of mental health care and offering renewed optimism to those in need.

Benefits Of Ketamine Treatment:

1. Rapid Onset of Relief:

Unlike traditional antidepressants, which may take weeks or even months to alleviate symptoms, ketamine has been shown to produce rapid antidepressant effects, often within hours or days of administration.

2. Treatment for Treatment-Resistant Conditions:

Ketamine therapy offers hope for individuals who have not responded to conventional antidepressant medications or psychotherapy, providing an alternative treatment option for those with treatment-resistant depression or other mental health disorders.

3. Reduction of Suicidal Ideation:

Studies have demonstrated that ketamine treatment may rapidly reduce suicidal thoughts and ideation, offering critical support to individuals experiencing acute distress and suicidal behavior.

4. Improved Mood and Functioning:

Ketamine therapy has been associated with improvements in mood, cognition, and overall functioning, allowing individuals to regain a sense of well-being and engage more fully in daily activities.

5. Long-lasting Effects:

While the immediate effects of ketamine treatment may subside after a few days or weeks, some individuals experience sustained relief from symptoms over time, with the potential for longer-lasting benefits beyond the initial treatment period.

6. Potential for Personalized Treatment:

Ketamine therapy can be tailored to individual needs, with treatment plans customized based on factors such as the severity of symptoms, treatment response, and tolerability.

7. Reduction of Inflammation:

Emerging research suggests that ketamine may have anti-inflammatory properties, which could contribute to its therapeutic effects on mood and mental health.

8. Safety and Tolerability:

When administered in a controlled medical setting by trained professionals, ketamine therapy is generally safe and well-tolerated, with few serious adverse effects reported.

Overall, ketamine treatment represents a promising frontier in mental health care, offering hope and healing to individuals who have not found relief with traditional treatments.

While further research is needed to fully understand its mechanisms of action and long-term effects, the potential benefits of ketamine therapy are undeniable, offering new pathways to recovery for those in need.

How Much Is Ketamine Treatment Without Insurance?

In the realm of mental health treatment, ketamine therapy has emerged as a groundbreaking option for individuals grappling with conditions like depression, anxiety, and PTSD. With its rapid onset of action and potential for long-lasting relief, ketamine treatment offers hope to those who have not responded to traditional therapies.

However, for individuals without insurance coverage, the cost of ketamine treatment can be a significant concern. In this article, we delve into the question of how much ketamine treatment costs without insurance, exploring the factors that influence pricing and discussing potential avenues for managing expenses.

By shedding light on the financial aspects of ketamine therapy, we aim to empower individuals to make informed decisions about their mental health care journey.

Ketamine Treatment Without Insurance:

1. Initial Consultation:

The cost of an initial consultation with a healthcare provider or ketamine clinic typically ranges from $200 to $500. During this appointment, the provider evaluates the individual’s medical history, assesses their suitability for ketamine treatment, and discusses treatment options and expectations.

2. Treatment Sessions:

The cost of ketamine infusion sessions can vary widely depending on factors such as the provider’s location, the clinic’s reputation, and the dose and duration of the infusion. On average, a single ketamine infusion session may range from $400 to $800 or more.

3. Number of Sessions:

The number of ketamine infusion sessions required varies based on the individual’s response to treatment and the severity of their symptoms. While some individuals may experience significant improvement after just one or two sessions, others may require multiple sessions over several weeks or months to achieve optimal results.

4. Maintenance Therapy:

After the initial series of ketamine infusions, some individuals may benefit from ongoing maintenance therapy to sustain the therapeutic effects. Maintenance sessions are typically less frequent than initial treatments but may still incur additional costs over time.

5. Additional Services:

In addition to ketamine infusion therapy, some providers may offer complementary services such as psychotherapy, psychiatric evaluations, or wellness programs. These services may incur additional charges beyond the cost of ketamine treatment itself.

6. Payment Plans and Financing Options:

Recognizing that the cost of ketamine treatment can be prohibitive for some individuals, many ketamine clinics offer payment plans or financing options to help make treatment more affordable. These arrangements allow patients to spread out the cost of treatment over time, easing the financial burden.

7. Discount Programs and Assistance:

Some ketamine clinics may offer discount programs or financial assistance to individuals who demonstrate financial need or meet specific eligibility criteria. These programs can help make ketamine treatment more accessible to those facing financial challenges.

8. Comparison Shopping:

It’s essential for individuals considering ketamine treatment to research and compare prices among different providers or clinics in their area. While cost is an important consideration, it’s also crucial to ensure that the provider offers high-quality care and adheres to safety protocols.

The cost of ketamine treatment without insurance can vary depending on several factors, including the provider’s fees, the number of sessions required, and any additional services offered.

By understanding the potential expenses associated with ketamine therapy and exploring options for managing costs, individuals can make informed decisions about pursuing this innovative treatment option for their mental health needs.

What Is The Eligibility For Coverage For BCBS?

Navigating the complexities of health insurance coverage can often feel like traversing a maze, with a myriad of terms, conditions, and eligibility criteria to decipher.

For individuals covered by Blue Cross Blue Shield (BCBS) insurance plans, understanding the eligibility requirements for coverage is essential in ensuring access to necessary healthcare services while minimizing out-of-pocket expenses.

In this article, we delve into the question of eligibility for coverage for BCBS, exploring the factors that determine whether an individual’s medical expenses will be reimbursed or covered by their insurance plan.

Eligibility For Coverage For BCBS:

1. Active Enrollment:

To be eligible for coverage under a BCBS insurance plan, an individual must be actively enrolled in the plan and maintain current membership status.

2. Plan Type and Coverage Level:

Eligibility for coverage may vary depending on the specific type of BCBS insurance plan and the level of coverage selected. For example, individuals enrolled in employer-sponsored plans, individual or family plans, Medicare plans, or Medicaid managed care plans may have different eligibility requirements and coverage options.

3. Premium Payments:

Maintaining eligibility for coverage under a BCBS insurance plan typically requires timely payment of premiums. Failure to pay premiums may result in the loss of coverage or suspension of benefits.

4. Geographic Coverage Area:

BCBS insurance plans may have specific coverage networks or service areas, and eligibility for coverage may be limited to individuals residing within these geographic regions. Out-of-network services may be subject to different coverage terms and reimbursement rates.

5. Qualifying Life Events:

Certain life events, such as marriage, birth or adoption of a child, loss of other health coverage, or changes in employment status, may qualify individuals for special enrollment periods or trigger eligibility for coverage under BCBS insurance plans.

6. Pre-existing Conditions:

BCBS insurance plans may have policies regarding pre-existing conditions, which are medical conditions that existed before the individual’s coverage began. Eligibility for coverage of pre-existing conditions may be subject to waiting periods, exclusions, or other limitations depending on the terms of the insurance plan.

7. Network Providers and Services:

Eligibility for coverage may be contingent upon receiving services from network providers or facilities participating in BCBS’s provider network. Out-of-network services may be covered at a lower reimbursement rate or may not be covered at all, depending on the terms of the insurance plan.

8. Authorization and Referral Requirements:

Some BCBS insurance plans may require authorization or referrals from primary care physicians or other healthcare providers for certain services or treatments to be eligible for coverage.

Eligibility for coverage under a Blue Cross Blue Shield (BCBS) insurance plan is influenced by various factors, including enrollment status, plan type, premium payments, geographic coverage area, and compliance with plan requirements.

By understanding the eligibility criteria established by BCBS and staying informed about their insurance benefits and coverage options, individuals can effectively navigate the complexities of health insurance and access the healthcare services they need with confidence.

How To Check Your Coverage?

Understanding your health insurance coverage is essential for ensuring access to necessary medical care while managing healthcare expenses effectively.

Whether you’re covered by a private insurance plan, employer-sponsored insurance, or a government program like Medicare or Medicaid, knowing the specifics of your coverage can help you make informed decisions about your healthcare needs.

The importance of checking your coverage and provide a comprehensive guide on how to do so. By empowering individuals with the knowledge and tools to navigate their insurance benefits, we aim to streamline the process of accessing healthcare services and maximizing the value of insurance coverage.

Check Your Coverage:

1. Review Your Insurance Policy:

Start by reviewing your insurance policy documents, including your insurance card, member handbook, and summary of benefits and coverage (SBC). These documents provide essential information about your coverage, including deductibles, copayments, coinsurance, and covered services.

2. Contact Your Insurance Provider:

Reach out to your insurance provider’s customer service department to inquire about your coverage details. You can find the contact information for your insurance company on your insurance card or their website. Be prepared to provide your policy number and personal information to access your coverage details.

3. Explore Online Resources:

Many insurance companies offer online portals or mobile apps where members can access their coverage information, view claims history, and check eligibility for services. Log in to your insurance provider’s website or app to explore these resources and access your coverage details conveniently.

4. Verify Provider Network:

If you have a preferred healthcare provider or facility, verify whether they are in-network with your insurance plan. Using in-network providers can help you minimize out-of-pocket expenses and maximize your insurance benefits.

You can typically search for in-network providers on your insurance company’s website or by contacting their customer service department.

5. Understand Coverage Limits and Exclusions:

Familiarize yourself with any coverage limits, exclusions, or restrictions that may apply to your insurance plan. These may include limitations on certain services, treatments, or medications, as well as requirements for pre-authorization or referrals for certain procedures.

6. Ask Questions:

Don’t hesitate to ask questions if you’re unclear about any aspect of your coverage. Contact your insurance provider’s customer service department or speak with your employer’s benefits administrator to seek clarification on coverage details, benefits, and any other concerns you may have.

7. Keep Documentation:

Maintain copies of important documents related to your insurance coverage, including your insurance card, policy documents, explanation of benefits (EOB) statements, and correspondence with your insurance provider. These documents can serve as valuable references and help you track your healthcare expenses.

8. Review Changes Annually:

Review your insurance coverage annually during open enrollment or whenever you experience a qualifying life event. Changes in your coverage, such as premium increases, benefit changes, or network updates, may impact your healthcare expenses and coverage options.

By following these steps and staying proactive about checking your health insurance coverage, you can ensure that you have the information you need to make informed decisions about your healthcare and maximize the benefits of your insurance plan.

Tips For Getting Coverage With Blue Cross Blue Shield

The intricacies of health insurance coverage can be a daunting task, but with the right knowledge and strategies, you can maximize your benefits and ensure access to the healthcare services you need.

For individuals covered by Blue Cross Blue Shield (BCBS) insurance plans, understanding how to navigate the system and maximize coverage is key to managing healthcare expenses effectively. In this article, we explore valuable tips for getting coverage with Blue Cross Blue Shield, from understanding your policy to advocating for your healthcare needs.

By empowering individuals with the tools and information to navigate their insurance coverage, we aim to streamline the process of accessing quality care while minimizing out-of-pocket expenses.

Tips:

1. Understand Your Policy:

Start by thoroughly reviewing your BCBS insurance policy documents, including your member handbook, summary of benefits, and coverage details. Understanding your policy’s terms, limitations, and coverage options is essential for making informed decisions about your healthcare.

2. Know Your Network:

Familiarize yourself with the network of healthcare providers and facilities that participate in your BCBS insurance plan. Using in-network providers can help you minimize out-of-pocket expenses and maximize your insurance benefits.

3. Check Coverage Before Seeking Care:

Before scheduling any medical services or procedures, check your coverage to ensure that the services are covered under your BCBS insurance plan. This can help you avoid unexpected costs and ensure that you receive the maximum benefit from your insurance coverage.

4. Preauthorization and Referrals:

Be aware of any preauthorization or referral requirements that may apply to certain medical services or treatments under your BCBS insurance plan. Obtaining preauthorization or referrals as needed can help ensure that your services are covered and reduce the risk of claim denials.

5. Advocate for Your Healthcare Needs:

If you believe that a particular treatment or service is medically necessary for your condition, don’t hesitate to advocate for yourself with your healthcare provider and insurance company. Providing documentation and medical evidence to support your request can strengthen your case for coverage.

6. Stay Informed About Coverage Changes:

Keep abreast of any changes to your BCBS insurance coverage, including updates to benefits, network providers, or coverage policies. Changes in coverage may impact your healthcare expenses and coverage options, so it’s essential to stay informed.

7. Utilize Online Resources:

Take advantage of online resources provided by BCBS, such as member portals, mobile apps, and customer service hotlines, to access your coverage information, track claims, and find in-network providers conveniently.

8. Seek Assistance if Needed:

If you encounter challenges or have questions about your BCBS insurance coverage, don’t hesitate to seek assistance from your insurance provider’s customer service department or a healthcare advocate. They can provide guidance and support to help you navigate the insurance process effectively.

By following these tips and staying proactive about managing your BCBS insurance coverage, you can maximize your benefits and ensure access to quality healthcare while minimizing out-of-pocket expenses.

Remember that understanding your policy, knowing your rights, and advocating for your healthcare needs are essential steps in getting coverage with Blue Cross Blue Shield.

What Should You Do If Your Blue Cross Does Not Cover Ketamine Treatment?

Ketamine therapy has emerged as a promising option for individuals grappling with conditions like depression, anxiety, and PTSD. However, for those covered by Blue Cross Blue Shield (BCBS) insurance plans, the question of coverage for ketamine treatment can be a significant concern.

Despite the growing recognition of ketamine’s therapeutic benefits, some BCBS plans may not provide coverage for this innovative therapy. In such cases, individuals may find themselves facing the dilemma of how to proceed with treatment while navigating insurance obstacles.

If your Blue Cross does not cover ketamine treatment, offering guidance and strategies for individuals seeking alternative avenues to access this potentially life-changing therapy.

What Should You Do:

Discovering that your Blue Cross Blue Shield (BCBS) insurance plan does not cover ketamine treatment can be disheartening, but it’s essential to explore alternative options and advocate for your healthcare needs. Here’s what you can do if your BCBS insurance does not cover ketamine treatment:

1. Review Your Policy:

Start by reviewing your BCBS insurance policy documents, including your member handbook and summary of benefits. Confirm whether ketamine treatment is explicitly listed as an excluded service or if coverage is subject to specific limitations or requirements.

2. Appeal the Decision:

If your BCBS insurance denies coverage for ketamine treatment, consider appealing the decision. Submit a formal appeal, providing supporting documentation from your healthcare provider, including medical records, treatment history, and evidence of the medical necessity of ketamine therapy for your condition.

3. Request a Case Review:

Request a case review from your BCBS insurance provider to reevaluate their decision regarding coverage for ketamine treatment. Present any additional information or arguments that support the medical necessity and effectiveness of ketamine therapy for your specific condition.

4. Explore Out-of-Network Options:

If ketamine treatment is not covered by your BCBS insurance plan, explore out-of-network options for accessing this therapy. While out-of-network services may incur higher out-of-pocket costs, it may be worth considering if ketamine therapy is deemed medically necessary for your condition.

5. Seek Financial Assistance:

Investigate financial assistance programs or patient assistance programs offered by ketamine clinics or pharmaceutical companies. These programs may provide discounts, grants, or other forms of financial support to help offset the cost of ketamine treatment for individuals who qualify based on financial need.

6. Consider Alternative Financing Options:

Explore alternative financing options, such as healthcare loans, medical credit cards, or payment plans offered by ketamine clinics or healthcare financing companies. These options can help you spread out the cost of ketamine treatment over time and make it more manageable.

7. Consult with Your Healthcare Provider:

Discuss your concerns and options with your healthcare provider, including alternative treatments or therapies that may be covered by your BCBS insurance plan. Your healthcare provider can help you explore alternative treatment options and develop a comprehensive care plan that meets your needs.

8. Seek Support and Resources:

Reach out to patient advocacy organizations, support groups, or mental health professionals for guidance and resources. These organizations can provide valuable information, support, and advocacy assistance to individuals seeking access to ketamine treatment and navigating insurance challenges.

If your Blue Cross Blue Shield insurance does not cover ketamine treatment, it’s essential to explore alternative options and advocate for your healthcare needs.

By reviewing your policy, appealing the decision, exploring out-of-network options, seeking financial assistance, and consulting with your healthcare provider, you can take proactive steps to access the care you need and deserve.

Remember that you are not alone, and there are resources and support available to help you navigate insurance obstacles and pursue the best possible treatment for your mental health.

Alternative Coverage Options For Ketamine Treatment

As awareness of the therapeutic benefits of ketamine treatment continues to grow, individuals seeking relief from conditions like depression, anxiety, and PTSD may face challenges when discovering that their insurance provider does not cover this innovative therapy.

In such cases, exploring alternative coverage options becomes imperative for those who wish to pursue ketamine treatment without shouldering the full financial burden. Alternative coverage options for ketamine treatment, offering insights and strategies for individuals seeking access to this potentially life-changing therapy.

From flexible payment plans to patient assistance programs, we explore various avenues that can help individuals overcome insurance obstacles and receive the care they need to improve their mental health and well-being.

Alternative Coverage Options:

When faced with the dilemma of insurance coverage gaps for ketamine treatment, exploring alternative options becomes essential. Here’s a detailed look at alternative coverage options for ketamine treatment:

1. Out-of-Pocket Payment:

Individuals may choose to pay for ketamine treatment out of pocket if their insurance provider does not cover this therapy. While this option may involve higher upfront costs, it provides the flexibility to access treatment without waiting for insurance approval or navigating coverage restrictions.

2. Healthcare Financing:

Healthcare financing options, such as medical loans or medical credit cards, offer individuals the ability to spread out the cost of ketamine treatment over time. These financing options typically provide competitive interest rates and flexible repayment terms, making treatment more accessible for those facing financial constraints.

3. Payment Plans:

Many ketamine clinics and healthcare providers offer flexible payment plans to accommodate patients’ financial needs. These payment plans allow individuals to pay for ketamine treatment in installments over a predetermined period, easing the financial burden and making treatment more affordable.

4. Patient Assistance Programs:

Some ketamine clinics and pharmaceutical companies offer patient assistance programs to help individuals afford ketamine treatment. These programs may provide discounts, grants, or other forms of financial assistance to eligible patients based on financial need.

5. Community Resources and Support:

Community organizations, nonprofit groups, and mental health advocacy organizations may offer resources and support to individuals seeking access to ketamine treatment. These organizations may provide information, referrals, or financial assistance to help individuals overcome barriers to care.

6. Research Studies and Clinical Trials:

Participating in research studies or clinical trials investigating the effectiveness of ketamine treatment for mental health conditions may provide access to treatment at reduced or no cost. Individuals interested in participating in research studies should consult with their healthcare provider or search for ongoing trials in their area.

7. Negotiate Fees and Discounts:

Individuals can explore the possibility of negotiating fees or seeking discounts with ketamine clinics or healthcare providers. Some providers may offer reduced fees or discounts for self-pay patients, especially if payment is made upfront or in cash.

8. Seek Insurance Reimbursement:

While some insurance providers may not cover ketamine treatment upfront, individuals can still submit claims for reimbursement after receiving treatment. Providing documentation of medical necessity and evidence of payment may increase the likelihood of reimbursement, although coverage is not guaranteed.

Alternative coverage options for ketamine treatment offer individuals the opportunity to access this innovative therapy despite insurance coverage gaps.

By exploring options such as out-of-pocket payment, healthcare financing, payment plans, patient assistance programs, community resources, research studies, negotiation, and insurance reimbursement, individuals can overcome financial barriers and receive the care they need to improve their mental health and quality of life.

Conclusion:

While Blue Cross Blue Shield (BCBS) insurance plans may vary in their coverage policies regarding ketamine treatment, individuals are encouraged to explore their specific plan details and eligibility criteria.

While some BCBS plans may offer coverage for ketamine therapy, others may not, leading individuals to seek alternative coverage options or explore out-of-pocket payment arrangements.

Regardless of insurance coverage, individuals should prioritize their mental health needs and work closely with healthcare providers to explore treatment options and access the care they need.

By advocating for themselves, seeking assistance from healthcare professionals, and exploring alternative avenues, individuals can navigate insurance obstacles and pursue the best possible treatment for their mental health. I hope now you understand Does Blue Cross Blue Shield Cover Ketamine Treatment

FAQs:

Q1: How Can I Find Out If My BCBS Plan Covers Ketamine Treatment?

A: To determine whether your Blue Cross Blue Shield (BCBS) insurance plan covers ketamine treatment, review your plan documents, including your member handbook and summary of benefits. You can also contact your insurance provider’s customer service department or check their website for information on coverage eligibility and benefits.

Q2: What Should I Do If My BCBS Plan Does Not Cover Ketamine Treatment?

A: If your Blue Cross Blue Shield (BCBS) insurance plan does not cover ketamine treatment, consider exploring alternative coverage options such as out-of-pocket payment, healthcare financing, or patient assistance programs offered by ketamine clinics or pharmaceutical companies.A: If your Blue Cross Blue Shield (BCBS) insurance plan does not cover ketamine treatment, consider exploring alternative coverage options such as out-of-pocket payment, healthcare financing, or patient assistance programs offered by ketamine clinics or pharmaceutical companies.

Q3: Are There Any Exceptions or Circumstances Where BCBS Might Cover Ketamine Treatment?

A: While coverage policies for ketamine treatment may vary among Blue Cross Blue Shield (BCBS) insurance plans, there may be exceptions or circumstances where coverage is available. “Does Blue Cross Blue Shield Cover Ketamine Treatment“

Individuals with documented medical necessity and evidence of treatment-resistant mental health conditions may have a better chance of obtaining coverage for ketamine therapy. “Does Blue Cross Blue Shield Cover Ketamine Treatment“

Q4: What Are Some Alternative Options If My BCBS Plan Does Not Cover Ketamine Treatment?

A: If your Blue Cross Blue Shield (BCBS) insurance plan does not cover ketamine treatment, consider exploring alternative options such as out-of-pocket payment, healthcare financing, payment plans offered by ketamine clinics, or patient assistance programs. “Does Blue Cross Blue Shield Cover Ketamine Treatment“